Automate Payroll Calculation with Papershift Time Tracking Software

Sign up for a free demo and save manual work with timesheet calculation.

Free payroll calculator from Papershift

Papershift Payroll supports all industries of all sizes

Our customers include companies of all sizes and from a wide range of industries. They have one thing in common: Each of them has individual requirements, and we treat each of them accordingly.Our success is proven by our customer stories.

EDEKA

Supermarket branch with 50+ employees

"With Papershift we were able to reduce our workforce planning workload significantly.

The integrated payroll accounting is particularly helpful, as we can take different wage types into consideration. This has saved us 70% of the previous time required at the end of the month."

Raphael Dirnberger - Store Manager

BURGER KING

Centrally managing 1000+ staff over 50 locations

"Papershift helps us to make shift planning more efficient, helps keep the employees better informed, and makes the administration of all employees easier for us."

Alexander Feitsch, TQSR Holding and Development

Weyline Taxis

Scheduling 20+ staff across several offices and recording timesheets

"Papershift does exactly what you want it to do - the shift plan doesn't let you plan people who are away and it's also very easy to see which employee you're planning.

It just works really well."

Tracey, Administration Assistant

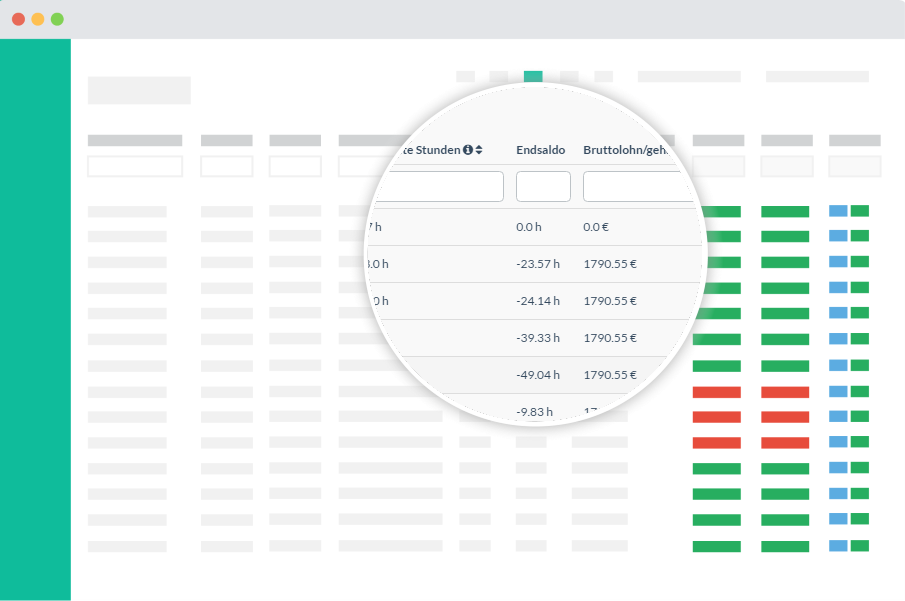

Overview of direct personnel costs to manage payroll

With Papershift’s Payroll addon, you always keep an eye on your employees’ gross pay, total payout amount per month, and employees’ hourly accounts.

Gross wages in focus

Gross wages and salaries, taking into account all types of wages, expenses, incentives, and surcharges.

An overview of hourly accounts

Based on the current hourly accounts of your employees, you can identify overtime build-up at an early stage and compensate for it by means of appropriate planning.

Payroll with integration

You always keep an eye on the total payout amount per month for your financial planning. Especially important for small and medium-sized enterprises to be able to estimate the costs for the current month.

Let's make payroll easy & fun to use

Check our guidelines and resources to help you automate payroll

Your frequently asked questions on Payroll calculator

What is Payroll?

In its simplest terms, payroll is the list of employees within a company who are entitled to receive payments as well as other work benefits from a business. One of the most important parts of any payroll is the calculations of amounts that each employee should receive on each pay day. As figures may change each month; payrolls are generally generated for each individual pay date.

Payrolls may also list a company’s records of previous payments made to employees, including salaries and wages, bonuses, and taxes. A business may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company.

What is a Payroll Calculator?

A payroll calculator is generally a software application that provides various payroll calculations. One of the fundamental things it will do is calculate and distribute wages to employees. It may also send money to other interested parties like regulatory boards and the tax office.

The software will automate many of the tasks of payroll. It can often take much of the information required to perform its calculations from the login details of staff. It will then complete payroll at specific time intervals set out by the business and distribute monies accordingly.

Payroll calculators may also be able to automatically consider the legal and tax obligations of a company and its staff. This is vital for preventing issues that may take time and resources to fix or cause problems with regulatory bodies.

What should a Payroll Calculator Be Able to Do?

There are many payroll calculator solutions available. Each generally offer core payroll calculation functions as well as, in many cases, various other processes. A good payroll system should include:

1. A way to automatically calculate money owed to employees and other interested parties. It will also often be able to transfer money directly to these parties on a specific date.

2. A way to automatically calculate tax and National Insurance burdens for staff. These should be easily amendable if required to keep up to date and in line with government regulations.

3. A way to automatically record tax burdens of the business. Nearly all payroll calculators will calculate business tax details and obligations.

What Are the Benefits of Using a Payroll Calculator?

There are many benefits to using a payroll calculator, including:

1. It reduces the time your HR team has to spend on tasks. A good payroll calculator will automate many of the tasks of an HR system. This can save time and reduce the number of man hours required to run payroll.

2. It automates many of the processes required to run payroll accounting. This can include things like calculating pay, taxes, and National Insurance contributions.

3. It reduces IT costs by lessening the need for an in-house IT team. A good payroll calculator makes running payroll easy and less reliant on in-house IT systems. This can reduce the need in larger businesses for technology specialists.

4. Payroll calculators are generally adaptable. This makes it easy to change variables like pay rates and even add new employees with ease.

What Should a Payroll Calculator Include?

If you are looking to employ a payroll calculator software system, here are a few features you need:

1. A way to calculate pay for employees. Many will even allow the money to be paid automatically.

2. A way to store and use tax codes and National Insurance rates for employees in calculations. These should be easily amendable.

3. A way to add new employees and remove those leaving employment easily. Staff turnover in the modern world is generally high. Being able to remove ex-employees from calculations while adding new ones is vital.

Our Payroll is trusted by small and medium businesses

Papershift has been awarded the CyberChampion Award for its solution in roster, employee absence and leave planning and time tracking.

Automation for payroll accounting

The personnel costs required for payroll accounting are calculated automatically and can be exported in the DATEV/SBS-optimized format. This way, the data can be easily forwarded to your payroll office or your tax advisor, where it can be offset against taxes and social security contributions, etc.

Always there to help you with Payroll & your questions

- Michael

Product Manager

- Alex H

Customer Success Manager

- Chris

Sales Lead

- Dylan

Account Executive

14 days free of charge and without obligation test.