Automate HMRC Paye calculation with Papershift Time Tracking Software

Sign up for a free demo and save manual work with timesheet calculation.

Free HMRC Paye calculator from Papershift

Papershift Payroll supports all industries of all sizes

Our customers include companies of all sizes and from a wide range of industries. They have one thing in common: Each of them has individual requirements, and we treat each of them accordingly.Our success is proven by our customer stories.

EDEKA

Supermarket branch with 50+ employees

"With Papershift we were able to reduce our workforce planning workload significantly.

The integrated payroll accounting is particularly helpful, as we can take different wage types into consideration. This has saved us 70% of the previous time required at the end of the month."

Raphael Dirnberger - Store Manager

BURGER KING

Centrally managing 1000+ staff over 50 locations

"Papershift helps us to make shift planning more efficient, helps keep the employees better informed, and makes the administration of all employees easier for us."

Alexander Feitsch, TQSR Holding and Development

Weyline Taxis

Scheduling 20+ staff across several offices and recording timesheets

"Papershift does exactly what you want it to do - the shift plan doesn't let you plan people who are away and it's also very easy to see which employee you're planning.

It just works really well."

Tracey, Administration Assistant

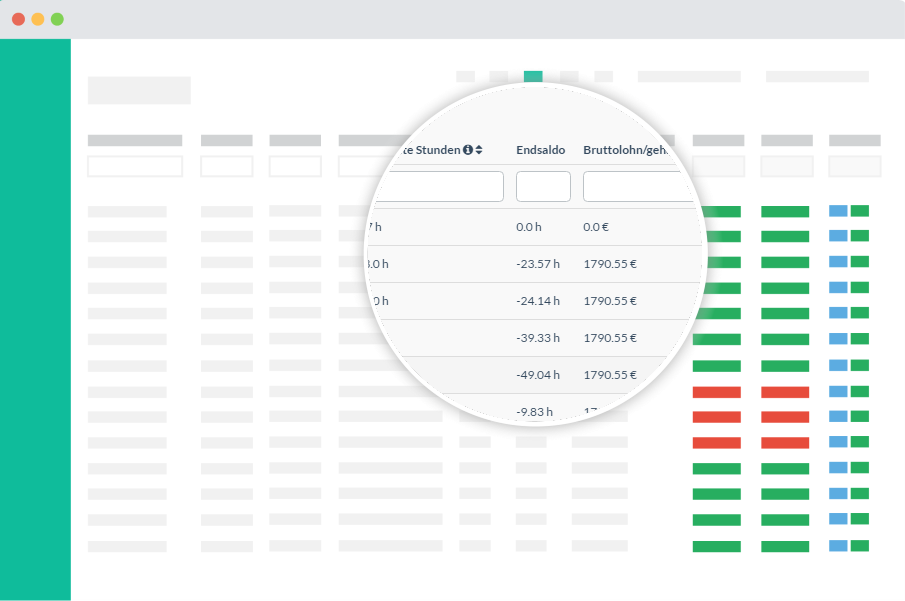

Overview of direct personnel costs to manage HMRC Paye calculation

With Papershift’s Payroll addon, you always keep an eye on your employees’ gross pay, total payout amount per month, and employees’ hourly accounts.

Gross wages in focus

Gross wages and salaries, taking into account all types of wages, expenses, incentives, and surcharges.

An overview of hourly accounts

Based on the current hourly accounts of your employees, you can identify overtime build-up at an early stage and compensate for it by means of appropriate planning.

Payroll with integration

You always keep an eye on the total payout amount per month for your financial planning. Especially important for small and medium-sized enterprises to be able to estimate the costs for the current month.

Let's make payroll easy & fun to use

Check our guidelines and resources to help you automate payroll

Your frequently asked questions on HMRC Paye calculator

What is a HMRC PAYE Calculator?

An HMRC PAYE calculator is a software programme for working out various work-based pay deductions. It is designed to be easy to use and guides users through pre-defined questions. Many calculators are online based (including the UK Government’s own) but some can be downloaded to a PC or handheld device. Some may form part of a larger accountant software package.

The purpose of the HMRC PAYE calculator is to calculate how much income tax and National Insurance liability an employee has. This can be for personal reasons or to allow an employer to understand how much money should be deducted from payroll. This can be essential for HR purposes.

What Types of Questions Does the HMRC PAYE Calculator Ask?

An HMRC PAYE calculator will ask a variety of questions to work out both tax and National Insurance liability. Some of the questions may be fill-in-the-blank space type, whilst others may require a simple yes or no answer from the user. Some PAYE tax calculation software give options to choose from. These may be in the form of check boxes or drop-down menus. You may find that there are variations in the questions asked depending on the software used. The essential information will, however, often remain the same.

What Information is Required to Use an HMRC PAYE Calculator?

Before sitting down at your computer to use a PAYE calculator, you will need to know a few things. These will include the tax code of the person in question as well as their gross or expected gross pay. If you have changed employment during the year you may have to do a little calculation to work out what your combined gross pay is/will be.

If you are using a PAYE calculator for your own taxes, you can find your tax code on your P45 if you have left employment, or your yearly P60 statement. You will also be notified of your tax code yearly directly from HMRC in a PAYE Coding Notice. This is normally received just before the beginning of each tax year. You may also receive a new one if your circumstances change during the year or if you require a new tax code.

How Do I Use a HMRC PAYE Calculator?

Once you have the required information listed above, it’s time to fire up the PAYE calculator.

The calculation program will often guide you through the process of working out your tax and NI deductions. Read the questions carefully on the screen and answer them as accurately as possible. Make sure you input the tax code as set out and be as accurate as you can with gross pay calculations, especially if you are estimating based on future income.

You will most likely be asked for the time period in question, although some calculators will only work if you have a yearly gross figure. Some payroll calculators may also ask for previous gross pay figures. Be as complete and accurate as possible, especially if you are calculating your own taxes. Any errors can give incorrect tax and National Insurance contribution figures.

Are There Any Types of Tax Payer That Cannot use the Government’s HMRC PAYE Calculator?

Yes, there are. You cannot use the Government’s HMRC Paye calculator to get a tax estimate online if:

1. You’re not a pay-as-you-earn (PAYE) taxpayer.

2. Your only source of income is from self-employment

3. Your only source of income is from state benefits

4. Your only source of income is from a State Pension

5. You contribute to a pension scheme through your employer

6. You’re repaying a student loan

Our Payroll is trusted by small and medium businesses

Papershift has been awarded the CyberChampion Award for its solution in roster, employee absence and leave planning and time tracking.

Automation for payroll accounting

The personnel costs required for payroll accounting are calculated automatically and can be exported in the DATEV/SBS-optimized format. This way, the data can be easily forwarded to your payroll office or your tax advisor, where it can be offset against taxes and social security contributions, etc.

Always there to help you with Payroll & your questions

- Michael

Product Manager

- Alex H

Customer Success Manager

- Chris

Sales Lead

- Dylan

Account Executive

14 days free of charge and without obligation test.